Share This

May 26, 2021

Business Recovery Grant Can Help BC Companies Improve Online Presence

Assistance for companies that move online (or improve their online presence) is among the ways that small and medium sized businesses in BC that have been impacted by COVID-19 can utilize a government grant.

It’s part of the BC Government’s Small and Medium Sized Business Recovery Grant program, which was recently extended until August 31st, 2021 (or until all the funds are used). This program is in addition to a separate grant that’s meant to help BC businesses create their own ecommerce websites.

Grant Requirements

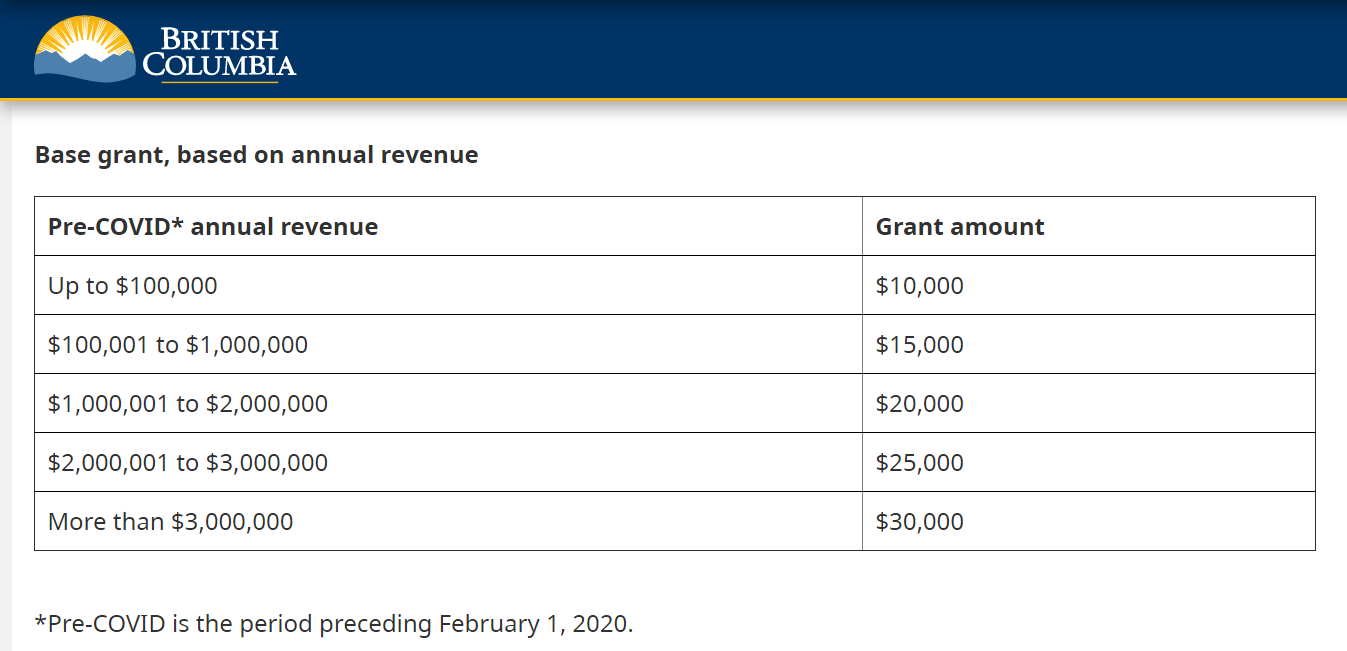

The recovery grant program is supporting local businesses that have suffered a revenue loss of 30% or more from March 2020 onward by providing anywhere from $10,000 to $30,000. An extra $5,000 to $15,000 is available to eligible businesses in the tourism industry. The exact amount that a business will receive is dependent on its pre-COVID annual revenue. A breakdown of how much various small or medium sized businesses can receive is below.

How Funding Can Be Used

There are several different ways that BC businesses can use the funds in order to help their recovery. As mentioned, one of the primary ways the funding can be utilized is by moving your business online or expanding its existing online presence.

The beauty of this particular initiative is it leaves plenty of room for interpretation. How you use the money depends on what strategy you think will work best to help your business recover from its financial hardships. That could include a newly designed website, an online store to offset the loss of in-person sales, a boost in digital marketing efforts, or a whole new digital strategy.

In addition to online initiatives, the government funding can be used for a variety of other expenses, including:

- Modifying your business location

- Increasing both online and offline marketing efforts

- Providing any type of new service or product to your clients

- Buying equipment to change or improve your goods or services

- Installing social distancing barriers at your physical business (e.g., glass barriers)

How To Apply And What You Need

If you’d like to apply for this grant, you must complete an online application from on the BC Government website and upload several different financial documents.

The required documents include the T1-T2125 Statement of Business or Professional Activities that indicate the percentage of ownership for unincorporated businesses and a Shareholder register or Certificate of Incorporation for incorporated businesses.

Additional documents that must be submitted include business tax returns from the last two reporting years and any payroll deductions from September 1st, 2019 up until now. You must also declare the past 24 months of monthly revenue. If your business has not been operating for 24 months, then 18 months of revenue is sufficient. Seasonal businesses should also provide information that is relevant to their specific business cycle.

Click here for the full checklist of required documents

Once again, more details on any aspect of the Small and Medium Sized Business Recovery Grant program can be found here.